Complete Guide for Purchasing Investment Property in Japan

Guide to Purchasing Investment Property in Japan

For those interested in purchasing investment property in Japan, the Japanese real estate market offers attractive opportunities. Many investors view Japan as a stable real estate investment destination. The growth of tourism and the increase in foreign workers are also supporting the market, in addition to Japan’s cultural and economic growth.

Understanding Japanese laws and procedures is essential for acquiring and managing investment properties. It is also important to be aware of the regulations and tax systems that vary by property type and region. When considering real estate investment in Japan, it is crucial to evaluate the demand and supply, as well as the future potential of each region.

Can Foreigners Own Investment Property in Japan?

Foreigners can own investment properties in Japan, but there are some restrictions. For example, under the Agricultural Land Act, foreigners are restricted from acquiring agricultural land unless certain conditions are met.

However, there are generally no ownership restrictions on buildings, making it possible to purchase buildings for investment purposes. It is important to understand the related procedures and tax payments.

Consulting with experts such as lawyers or real estate professionals familiar with Japanese laws and regulations is crucial for smooth transactions. Additionally, consulting with tax professionals can provide advice on proper tax payment methods.

What Taxes Apply to Real Estate in Japan?

Various taxes apply when acquiring real estate in Japan. The most common tax is the registration and license tax, which is imposed when registering the property. Local taxes such as the city planning tax and fixed asset tax are also required. If the property generates rental income, income tax and resident tax apply. When selling property, capital gains tax is applicable.

These taxes vary depending on the property type and region, so consulting with experts is important. Especially for overseas investors, understanding Japan’s tax system is essential. Collaborating with tax experts is key to successful real estate investment.

Steps to Purchasing Real Estate in Japan

When considering purchasing real estate in Japan, there are several important steps. First, clarify your budget. Understanding your budget helps in selecting specific properties smoothly.

Next, acquire knowledge about the Japanese real estate market and laws. Prices and demand vary by region, so understanding market trends and future potential is important.

Understanding the types of properties is also crucial. Compare the characteristics, advantages, and disadvantages of apartments, houses, and condominiums.

In real estate investment, it is important to collaborate with reliable real estate agents, lawyers, and accountants. Their advice facilitates smooth transactions.

Finally, carefully check the condition of the property, including the internet and facilities, and consider whether future profits can be expected. Thorough preparation and planning are essential for successful investment.

Contacting an Agent

For those considering real estate investment in Japan, contacting a reliable real estate agent is important. First, compare multiple agents and research their expertise and services. Communication with the agent is essential to avoid misunderstandings due to language barriers or geographical constraints.

Clearly communicate specific requirements, budget, and preferences to the agent. Also, confirm whether the agent offers support such as local property tours or online materials for remote property selection.

Asking questions to the agent is also important. Testing the agent’s knowledge of market trends and regional regulations helps evaluate their expertise and responsiveness.

Ultimately, a partnership with a reliable agent is key to successful real estate investment.

Consulting with Banks on Loans

Consulting with banks on loans is an important step in real estate investment in Japan. First, clarify the purpose of the loan and the repayment plan with the bank. Understanding the bank’s screening criteria, interest rates, and loan conditions is crucial.

Preparing necessary documents such as income certificates and property valuation is essential for obtaining a loan. Consulting with multiple banks allows comparison of interest rates and loan conditions.

Additionally, consider the repayment plan and future risks when obtaining a loan. Developing a long-term financial plan and preparing for variable interest rates and risks is necessary. Careful consideration and precise negotiation are indispensable when obtaining a loan.

Property Inspection

Property inspection is a critical step in real estate investment. By inspecting specific properties, you can estimate future profits. First, check the property’s location. The surrounding environment, transportation access, and convenience significantly impact investment success. Next, carefully observe the condition of the building. Check the state of the rooms, common areas, and facilities, and determine whether repairs or renovations are necessary.

Compare similar properties and consider market prices, demand, and supply to make the best choice. Additionally, consider the potential for future value appreciation and rental demand during the inspection. Property inspection is an essential due diligence activity in selecting investment properties.

Expressing Intent to Purchase

If you wish to express your intent to invest in the Japanese real estate market, it is important to do so clearly. The most common way to express your intent is to directly inform the seller or real estate agent of the property you wish to purchase. During property inspections, you can express your interest and negotiate specific prices and conditions.

Another way is to communicate your intent through a reliable real estate agent. Professionals can negotiate on your behalf, facilitating smooth transactions. In this case, the agent communicates the buyer’s intentions to the seller and supports transactions under favorable conditions.

When expressing your intent to purchase, it is important to accurately communicate property details and preferences. Preparation for price negotiation and contract conditions ensures smooth progress.

Clear communication and timely negotiation are key points in expressing your intent to purchase.

Negotiation and Initial Payment

Price negotiation is common in the Japanese real estate market. Initial payment is also an important aspect. First, regarding the property price, price negotiation is common in Japan. Consider the property’s condition and demand situation when negotiating the price.

Initial payment includes various costs besides the property price. In real estate transactions, initial payments include contract money, fees, registration costs, and fixed asset taxes. It is important to budget for these initial payments in advance. Understanding each initial payment and negotiating as much as possible is advisable to reduce the actual payment burden.

Contract Signing

When signing a real estate purchase contract, it is essential to proceed with expert advice. First, understand the contract’s content and agree to satisfactory terms. Next, confirm specific transaction conditions, such as the payment schedule and delivery timing. Finally, examine the contract’s content from a legal perspective and take measures to prevent potential issues. Cooperation with reliable lawyers and real estate agents is indispensable for smooth contract signing.

Final Settlement

The final step in purchasing real estate in Japan is the final settlement process. First, create the final contract based on the agreed conditions between the seller and buyer. This contract includes the sales conditions, property details, deposit payment schedule, and delivery date. After creating the contract, the remaining payment is made towards the delivery date.

On the delivery date, conduct the final property inspection. Reconfirm the building and site’s condition to ensure it meets the contract’s terms. Additionally, pay the remaining purchase price and miscellaneous expenses, and officially take possession of the property. Subsequently, registration procedures are carried out, completing the ownership transfer.

The final settlement is a major milestone in real estate transactions. Accurately understand the sales conditions and procedures, and proceed with expert advice. Achieve your ideal property through smooth procedures.

Recommended Investment Property Areas by City

When searching for investment properties in the Japanese real estate market, there are recommended areas for each city. For example, in Tokyo, central areas like Shibuya and Shinjuku are popular, attracting tourists and foreign expatriates. These areas also have high rental demand, offering potential rental income.

In Osaka, business and entertainment districts like Umeda and Tennoji are suitable for investment. These areas have high demand for offices and commercial facilities, ensuring stable rental income.

Regional cities like Sapporo and Fukuoka also have attractive investment areas. Growing cities like these have increasing demand for housing from young people and families, attracting attention.

Understanding the characteristics and supply-demand balance of each city is crucial when selecting investment properties.

Tokyo

Tokyo is an attractive area for real estate investment in Japan. Central areas like Shibuya and Shinjuku consistently have high demand, offering potential rental income. These areas attract many foreign expatriates and tourists, ensuring long-term demand.

Additionally, Tokyo’s infrastructure and real estate market growth have been highlighted by the impact of the Olympics and Paralympics, making it a promising area for investors. However, high land prices and competition are challenges. Consider the demand-supply balance and conduct thorough market research when investing in Tokyo real estate.

Osaka

Osaka is Japan’s third-largest city, known for its economic and cultural center. It has many business and entertainment districts, making it a popular area for tourists.

Areas like Umeda and Tennoji in Osaka are suitable for investment. These regions have many office buildings and commercial facilities, ensuring stable rental demand. Additionally, Osaka is famous for its rich food culture, attracting attention to restaurant businesses.

Osaka’s excellent transportation infrastructure, including Shinkansen and airport access, makes it popular with businesspeople, tourists, foreign students, and expatriates.

When considering real estate investment in Osaka, carefully examine regional demand, property types, and surrounding environments, and develop an investment strategy with future profits in mind.

Yokohama

Yokohama, a large city with a population of about 3.7 million, is a major port city adjacent to Tokyo. With excellent access to central Tokyo and many commercial facilities and tourist spots, Yokohama has stable rental demand.

Areas like Minato Mirai and around Yokohama Station have many offices and commercial facilities, attracting foreign expatriates and tourists. These areas have high demand for office rentals and luxury rental apartments, making them suitable for investment. Additionally, residential areas in Yokohama have demand for family and single-person rental housing.

Yokohama’s future potential is promising, with increasing tourists and foreign expatriates, enhancing its value as an investment property. Yokohama has diverse rental demand, making it an attractive area for investors.

Kyoto

Kyoto is known as Japan’s cultural and tourist center, attracting many tourists. It is rich in historical buildings and traditional culture, offering different seasonal charm. The high demand for accommodation and restaurants supports investment in properties around tourist areas.

Kyoto also has a side as an academic city with many universities and research facilities, creating demand for student and researcher rental housing. Kyoto’s population is gradually increasing, boosting housing demand. Considering Kyoto’s dual aspects as a tourist and academic city is crucial when choosing investment properties.

Sapporo

Sapporo, located in Hokkaido, offers a natural environment and many tourist attractions. The increasing number of tourists boosts demand for accommodation and vacation rentals. Sapporo is also known for attracting young people and families, expanding housing demand. Central areas like Odori and along subway lines have high rental demand, making them suitable for investment.

Additionally, Sapporo’s high level of education and medical facilities supports rental demand from students and medical professionals. Suburban areas surrounded by nature are popular with those seeking a tranquil environment.

Sapporo’s seasonal charm and expected economic growth make it a notable city for real estate investors.

Nagoya

Nagoya, located in the Chubu region, is Japan’s third-largest city. Its growing population drives housing demand, making it suitable for investment.

Central areas like Nagoya Station and Sakae have many office buildings and commercial facilities, ensuring active rental demand. Nagoya’s role as a major corporate hub and industrial area creates demand for expatriate and technical staff rental housing.

Public transportation improvements enhance accessibility, making Nagoya’s city center an attractive area for stable rental income.

Known for its historical tourist sites, Nagoya attracts many tourists and business visitors, creating demand for short-term accommodation and vacation rentals. Considering Nagoya’s future potential, the city center is worth evaluating for real estate investment.

How to Find a Good Real Estate Agent

When choosing a real estate agent, consider factors such as reliability, experience, and local knowledge.

First, research reviews and testimonials. Confirming past transaction performance and customer satisfaction helps find a trustworthy agent. Experience and expertise are also important. For foreign investors, ensure the agent can communicate in English or other languages.

Choosing an agent with local knowledge is crucial. Agents specializing in specific regions can provide detailed information on market trends and local regulations.

Smooth communication is essential for successful real estate transactions, making it important to find an agent with whom you can communicate effectively.

What Are the Benefits of Real Estate Investment in Japan?

For many investors, the Japanese real estate market offers a stable and attractive option. The stability of Japan’s economy and high demand for real estate are key reasons.

Additionally, renting out acquired properties can provide monthly cash flow. Other benefits include the reliability of Japan’s legal system, transparency of the real estate market, and long-term sustainability as an investment. Furthermore, the high quality of buildings and attractive landscapes in certain locations are important advantages for investors.

Costs and Required Documents

Understanding the costs and required documents for real estate investment in Japan is important. In addition to the purchase price, there are fees and taxes. Taxes include real estate acquisition tax and registration and license tax. Fees for contract creation and judicial scrivener services are also necessary. Additionally, there are ongoing costs such as property management fees and repair reserves.

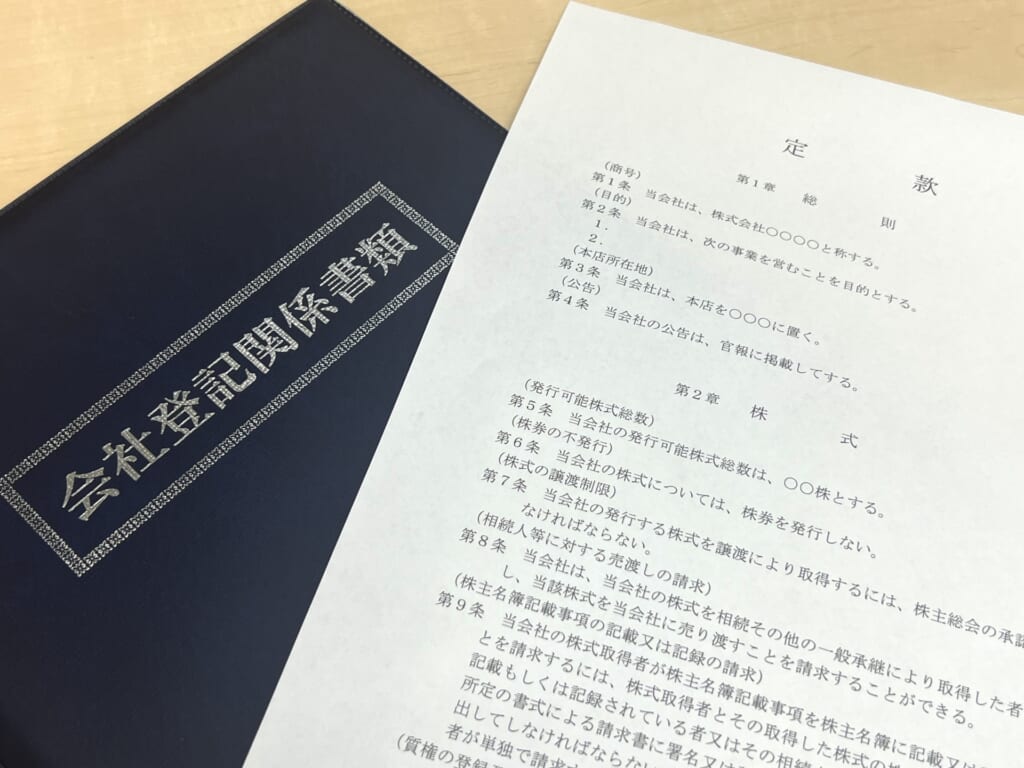

Required documents for foreigners include a passport, family register copy, income certificate, and bank balance certificate. For corporations, documents such as a certificate of registered matters and a certificate of incorporation are needed. If these documents are not in Japanese, translations may be required, taking time.

Understanding and preparing for these costs and required documents ensures smooth real estate investment.

Purchase Costs

Real estate investment purchase costs comprise several elements. The main component is the property purchase price. Other costs include real estate acquisition tax, registration and license tax, brokerage fees, and notarization fees. Property management fees for tenant recruitment and ongoing management should also be considered.

Estimating these costs accurately and planning finances is important. If using a loan, interest rates and related fees must be included. Calculating the investment property’s yield and understanding total costs is the first step to success.

Ongoing Costs

Japanese real estate investment involves ongoing costs beyond initial expenses. For example, property management fees and repair reserves are monthly running costs. Local taxes such as fixed asset tax and city planning tax are continually imposed on property owners.

Additionally, consider comprehensive insurance to cover potential vacancies and issues. Insurance premiums are an expense impacting property income. Preparing a reserve fund for unexpected repairs or renovations is wise.

Planning and addressing these ongoing costs enhance real estate investment profitability and risk management.

Frequently Asked Questions

Here are answers to frequently asked questions about real estate investment in Japan.

Yes, non-residents can invest in Japanese real estate. With expert advice and proper procedures, investment is possible.

Property prices vary by region and type, but typically 20% to 30% of the price is needed as a down payment.

Returns vary by property type and location but generally range from 4% to 8%.

Property management is usually handled by property management companies, responsible for leasing and maintenance. Selecting a suitable management company is crucial.

Conclusion

This guide summarizes key points about real estate investment in Japan. The Japanese real estate market offers stable investment opportunities. When selecting investment properties, consider regional supply-demand balance and future potential. Understanding Japanese laws, procedures, regional regulations, and tax systems is essential.

There are various property types, such as apartments, houses, and commercial facilities. Property management and rental contract operations are also important. For foreign investors, the Japanese real estate market is an attractive option, supported by Japan’s economic growth and increasing foreign tourists.

When considering real estate investment in Japan, understanding these points and conducting thorough research and consideration is crucial.